As of July 2024, an estimated 257,449 Marion County households were below the Asset Limited, Income Constrained, Employed (ALICE) threshold. While ALICE households earn above the Federal Poverty Level (FPL), they cannot afford basic costs of living in their county, especially as the cost of basic necessities increases faster than the overall rate of inflation. Childcare costs also can present one of the highest ALICE Survival Budget costs, the bare minimum expenses of basic necessities, for households with youth.

ALICE Households

ALICE households are those that are Asset Limited, Income Constrained, Employed. These are families and individuals who earn above the federal poverty level, but not enough to afford basic household necessities such as housing, child care, food, transportation, health care, and technology.

Despite being employed—often in essential jobs—ALICE households live paycheck to paycheck and are one unexpected expense away from financial crisis. This term was developed by the United Way to better capture the struggles of working families who are often overlooked by traditional poverty measures.

Income and Wages

Prosperity Indiana estimates the living wage at $19/hour. However, 10 of Indiana’s top 20 largest occupations pay lower than this threshold. More than half (53%) of households below the ALICE threshold in Indiana report that it was ‘somewhat’ or ‘very difficult’ to pay for food, rent or mortgage, car payments, and medical expenses, according to a 2023 survey.

According to the Brookings Institution, the burden of the rising cost of everyday necessities falls much more heavily on Black and Latino/a/e/x families. At least one quarter of American households do not have a bank account or rely on costly payday lenders and check-cashing outlets to pay their expenses. According to Aulds (2022), unbanked individuals face several financial disadvantages, including an inability to build financial wealth.

In 2019, unbanked rates were higher among Black (13.8%) and Latino/a/e/x (12.2%) households. In Marion County, 19% of Black and 25% of Latino/a/e/x households are considered unbanked.

Access to Capital for Small Business Owners

In Indianapolis, the lack of generational wealth significantly impacts the ability of business owners to secure loans based on current loan scoring models. While Black and Latino/a/e/x residents make up 29% and 11% of the population, they only own 4% and 2% of all businesses, respectively.

For instance, Black and Brown small business owners in Indianapolis face several challenges when attempting to access capital. These include:

- Higher loan rejection rates and lower approval amounts: Studies indicate that Black and Latino/a/e/x-owned businesses experience higher rates of loan rejections and receive smaller loan amounts compared to their white counterparts. This disparity limits their ability to invest in and grow their businesses.

- Limited access to networks: Many Black and Latino/a/e/x entrepreneurs lack access to investors, mentors, and customers, which are crucial for business development and securing funding opportunities. This absence of networks can hinder their ability to navigate the financial landscape effectively.

- Economic discrimination: Black and Latino/a/e/x-owned businesses often face discrimination from suppliers and financial institutions, leading to challenges in securing necessary capital for their operations.

- Underrepresentation in venture capital: The venture capital industry has been criticized for its lack of diversity, resulting in Black and Latino/a/e/x entrepreneurs receiving a disproportionately small share of venture funding. This underrepresentation limits their access to substantial capital necessary for scaling their businesses.

Addressing these challenges demands focused support to ensure all entrepreneurs — especially those facing systemic obstacles — have equitable access to resources and opportunities.

Current State

Nearly half of all Marion County residents do not earn a livable wage. As a result, many are unable to generate wealth and pass it on to the next generation. Low college persistence rates; systemic barriers to upskilling opportunities and high-paying jobs; and lack of access to capital and technical assistance (for Black, Indigenous, and People of Color [BIPOC] entrepreneurs) and credit (for low-wage earners) disproportionately trap low-income and residents of color in the cycle of poverty.

“ Low-income children born in Indianapolis grew up to earn $27,000 per year on average, the same as their parents’ income 35 years earlier. This means mobility in Indianapolis is worse than for any other city in the Midwest, except for Muncie and Anderson. ”

Economic Strategies and Tactics

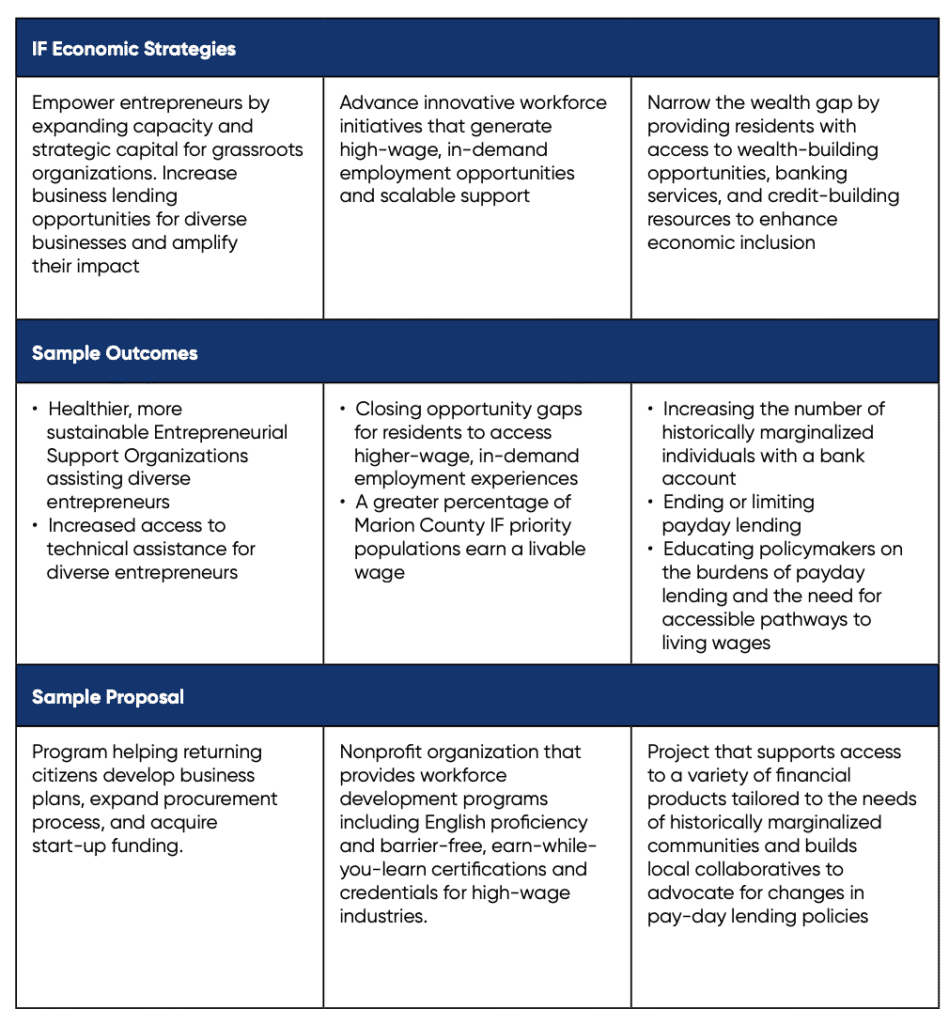

-

Narrow the wealth gap by providing residents with access to wealth-building opportunities, banking services, and credit-building resources to enhance economic inclusion.

- Convene stakeholders to understand the issues, explore alternatives, and identify innovative ideas ready to be piloted or scaled.

- Invest in key organizations, and support efforts to eliminate payday loans, reduce maximum allowable interest rates, and increase the minimum wage.

- Initiate narrative change work, elevating that wealth is systematically stripped out of poor communities by predatory practices and policies.

-

Empower entrepreneurs by expanding capacity and strategic capital for grassroots and community-focused organizations, increasing access to business lending for underrepresented business owners, and amplifying their impact.

- Establish an entrepreneurship support organization (ESO) fund.

- Strengthen the capacity of entrepreneur support organizations (ESOs) to deliver technical assistance, networking opportunities, and mentorship to business owners facing systemic barriers in Marion County.

- Support efforts to partner with local government and other public entities to adopt equitable contracting and procurement policies and processes.

-

Advance innovative, community-driven workforce initiatives that create pathways to high-wage, in-demand employment and provide scalable support.

- Sustain and scale efforts that close gaps and eliminate barriers between historically excluded workers and access to livable-wage jobs.

- Invest in capacity, technical expertise, and networks of organizations serving opportunity youth and justice-impacted individuals – two populations that face additional barriers to workforce participation.

- Support advocacy coalitions and organizations working to eliminate systemic barriers to workforce participation.

Sample Outcomes | Proposals

This graph highlights sample outcomes and proposals that reflect our commitment to advancing economic equity through the Equity Imperative 2030 strategic plan. The following examples demonstrate how we aim to support efforts that expand economic opportunity, increase access to quality jobs, and remove barriers to wealth-building for individuals and families across Indianapolis.